All Categories

Featured

Table of Contents

A degree term life insurance policy plan can give you peace of mind that the individuals who depend on you will certainly have a fatality advantage during the years that you are preparing to support them. It's a means to assist care for them in the future, today. A degree term life insurance policy (often called degree costs term life insurance policy) policy provides protection for an established variety of years (e.g., 10 or two decades) while keeping the costs payments the very same for the period of the policy.

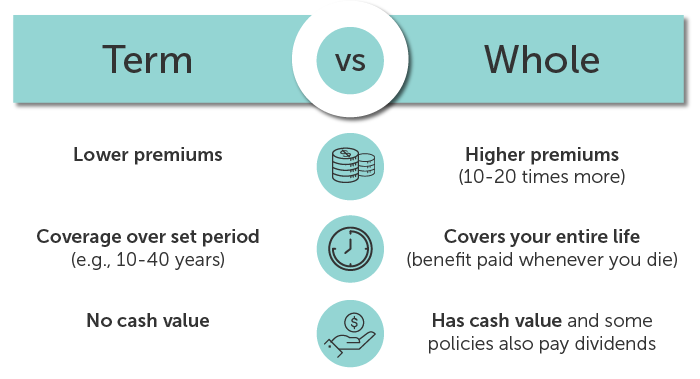

With degree term insurance, the cost of the insurance policy will certainly stay the same (or potentially reduce if returns are paid) over the term of your policy, normally 10 or 20 years. Unlike irreversible life insurance policy, which never expires as lengthy as you pay costs, a degree term life insurance policy policy will certainly end eventually in the future, commonly at the end of the duration of your degree term.

What is the Meaning of Level Term Vs Decreasing Term Life Insurance?

Since of this, several individuals make use of long-term insurance as a steady monetary preparation device that can serve many requirements. You might be able to convert some, or all, of your term insurance during a set period, typically the first one decade of your plan, without needing to re-qualify for protection also if your health has actually changed.

Navigating life insurance options can be overwhelming, especially with so many policies available. This is where working with an experienced insurance broker or agent makes all the difference. Unlike insurance agents tied to a single provider, brokers offer access to multiple life insurance options, helping you find the most suitable policy for your needs - instant life insurance quotes from an agent. Whether it’s term life insurance for temporary coverage, whole life insurance for lifelong protection, or universal life for long-term growth, an insurance broker evaluates your unique goals and compares providers to secure the best coverage at competitive rates

For families, policies like final expense insurance, mortgage protection, and accidental death coverage offer tailored solutions to protect loved ones. Business owners can also benefit from key person insurance, ensuring continuity in the event of an unforeseen loss. With life insurance policies offering living benefits or instant coverage, brokers simplify the decision-making process and ensure your financial priorities are met.

By choosing the right insurance broker, you gain expert guidance, access to personalized recommendations, and the confidence of knowing your family or business is secure. Contact an insurance broker today to explore tailored life insurance options and secure peace of mind for the future.

As it does, you may desire to include to your insurance policy protection in the future - Term life insurance with accelerated death benefit. As this happens, you may desire to ultimately lower your fatality advantage or take into consideration converting your term insurance to an irreversible policy.

Long as you pay your premiums, you can relax very easy recognizing that your liked ones will certainly get a death benefit if you pass away throughout the term. Several term plans allow you the capacity to transform to long-term insurance coverage without having to take one more wellness exam. This can allow you to make use of the extra advantages of a long-term policy.

Level term life insurance policy is one of the easiest courses into life insurance policy, we'll talk about the benefits and disadvantages to ensure that you can choose a strategy to fit your requirements. Degree term life insurance coverage is the most typical and fundamental form of term life. When you're searching for momentary life insurance coverage plans, degree term life insurance policy is one route that you can go.

You'll load out an application that includes basic individual details such as your name, age, and so on as well as a more detailed survey concerning your medical history.

The short answer is no. A degree term life insurance plan doesn't build money value. If you're looking to have a policy that you have the ability to withdraw or borrow from, you may check out permanent life insurance. Entire life insurance policy plans, for instance, allow you have the comfort of fatality advantages and can accumulate cash value over time, meaning you'll have more control over your advantages while you live.

What is Guaranteed Level Term Life Insurance? How It Works and Why It Matters?

Bikers are optional provisions included to your policy that can provide you fringe benefits and securities. Riders are a wonderful method to add safeguards to your policy. Anything can happen throughout your life insurance policy term, and you intend to be prepared for anything. By paying simply a bit more a month, cyclists can provide the support you need in instance of an emergency.

This cyclist offers term life insurance policy on your kids with the ages of 18-25. There are instances where these advantages are built right into your plan, yet they can additionally be offered as a separate enhancement that calls for extra settlement. This cyclist offers an extra survivor benefit to your recipient ought to you pass away as the result of a mishap.

Latest Posts

Final Expense Protection Life Insurance

Buy Burial Insurance Online

Funeral Plan Insurance